Gift tax calculator

Tax deductible gift types. This exemption is per.

Tom Hruise Was An Entertainment Executive Who Had A Chegg Com

Gifting is a popular way to reduce inheritance tax liability.

. Calculate the potential tax benefits associated with gifts of cash andor appreciated assets publicly traded securities closely held stock or real estate during your lifetime. Gift tax tables. Gift 350000 Minus the Inheritance Tax threshold on 27 March 2021 325000.

Select your tax year. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. That means you can give up to 1206 million without owing any gift tax.

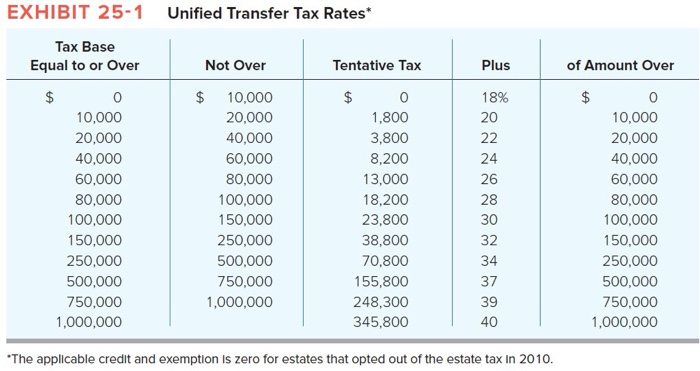

This page will be updated as more information becomes. Calculate the gift tax based on the total value of the gift. Many states impose their own estate taxes but they tend to be less than the federal estate tax.

Annual Gift Tax Exclusion. The Inheritance Tax due is 32000. The IRS allows individuals to give away a specific amount of assets or property each year tax-free.

It does not show any amounts that may pass to others using an exclusion or deduction including any additional. Choose your filing status from the drop-down list. This calculator calculates gift tax based upon the taxable gifts that you input.

Inheritance Tax due on the gift is calculated in this way. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. This app is an app to calculate the gift tax in Korea.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. But her friend must pay Inheritance Tax on her 100000 gift at a rate of 32 as its above the tax-free threshold and was given 3 years before Sally died. To be tax deductible a donors gift must be covered by what we call a gift type.

Davids estate on death is 500000. Calculate deductions tax savings and other benefitsinstantly. In 2022 the annual gift tax exemption is.

We have applied to the 2016 tax law. If their gift falls into more than one gift type category they can choose the gift type. In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS.

The Estate Tax Calculator estimates federal estate tax due. Enter the value of the gifts you have given during the selected tax year. How the gift tax is calculated and how the annual gift tax exclusion works.

Features - Gift tax calculation - Save result of calculation - Tax Counseling tax. This means that although gifts are free of tax up until the threshold of 5000 you must not deduct. Calculate the potential tax benefits associated with gifts of cash andor appreciated assets publicly traded securities closely held stock or real estate during your lifetime.

This calculator is mainly intended for. This calculator is designed to help you understand some of the key areas of gifting as a starting point to providing specific advice for. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

Tax Exempt Bonds. Use this free no-obligation tool to find the charitable gift thats right for you. In light of these changes the Connecticut Gift Tax Calculator should be used primarily for calculating historical results.

How to use the gift tax calculator.

2020 Estate Planning Update Helsell Fetterman

Income Tax Formula Excel University

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

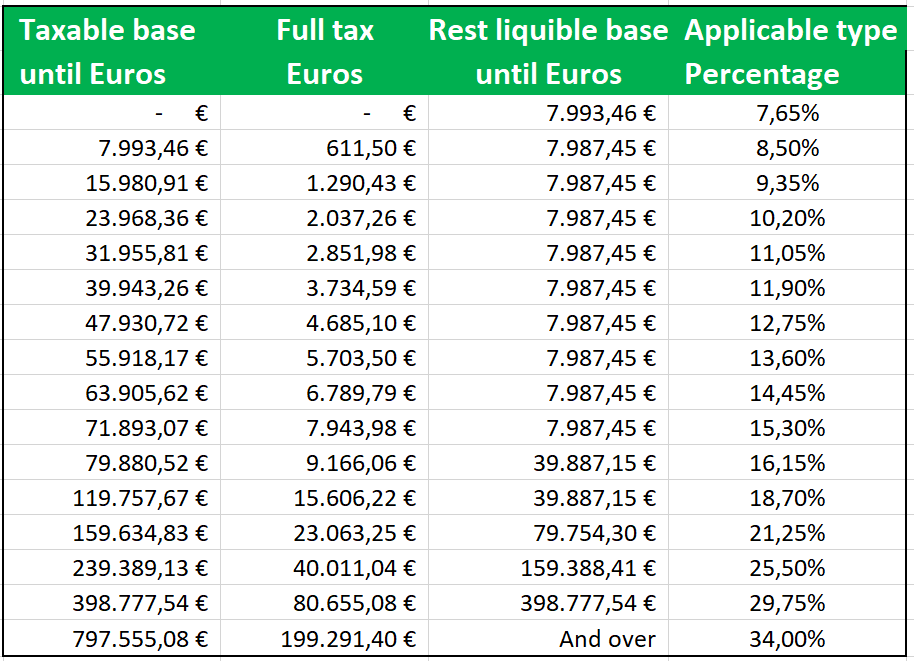

Spanish Inheritance Tax 2021 10 Things You Need To Know C D Solicitors

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Crypto Gift Tax Your Guide Koinly

2022 Transfer Tax Update

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How Does The Gift Tax Work Personal Finance Club

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

Nyc Nys Transfer Tax Calculator For Sellers Hauseit